Treasury Prime

SaaS Dashboard – Enterprise – In-house

Treasury Prime is a bank-as-a-service provider that helps fintech and banks develop financial solutions.

Problem

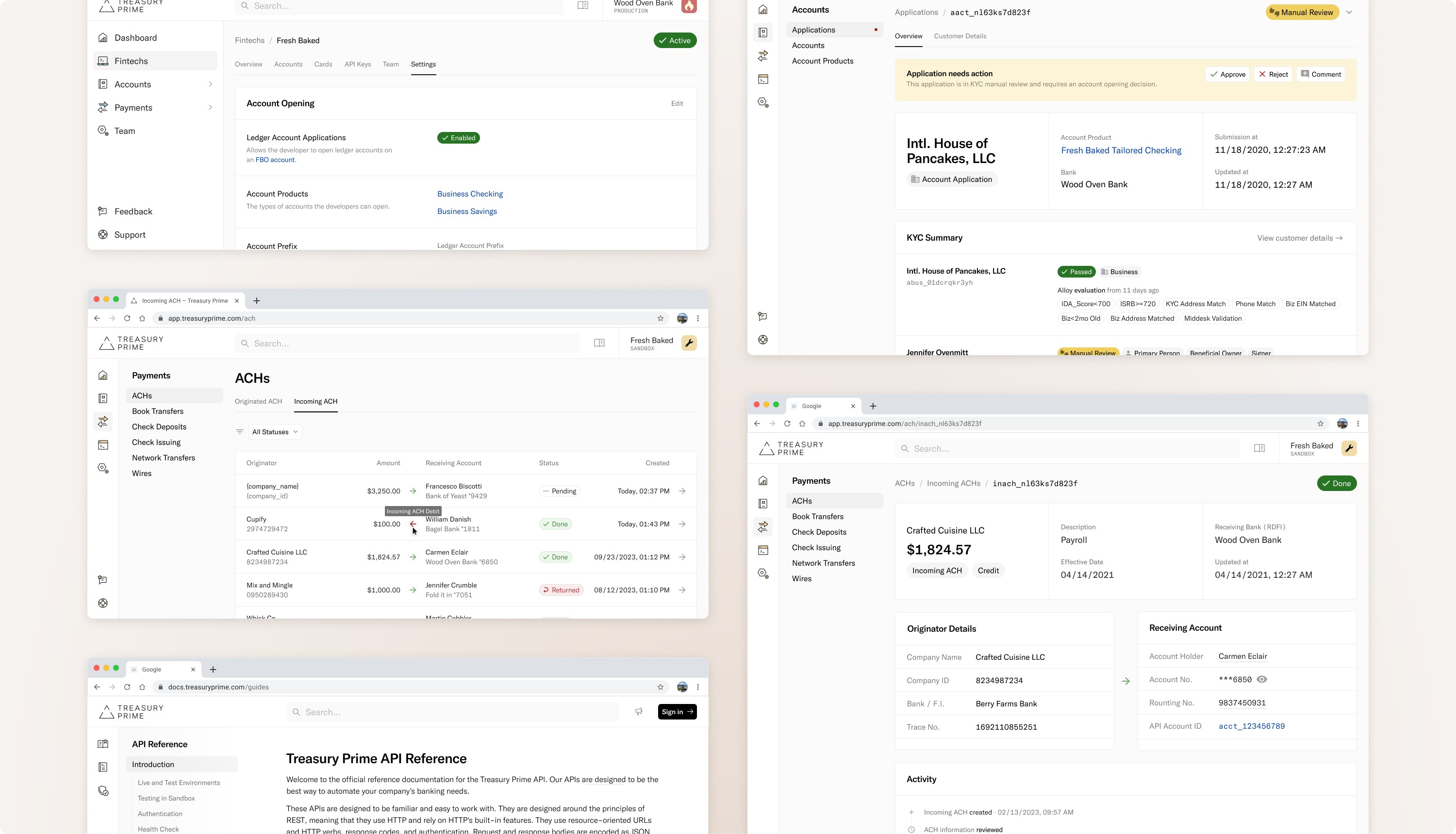

Initially, the dashboard had two limited experiences: one to support fintech engineers familiar with our APIs and the other to aid banks in reviewing applications.

The dashboard's limited features meant that banks and fintech companies had to rely on our internal team to support their customers and comply with banking regulations.

ROLE

Senior Product Designer

TEAM

1 Designer

1 PM

4 Engineers

Approach

After understanding how the APIs worked and where the main gaps in the dashboard experience were, I structured my work around these three objectives:

Close feature gaps to support bank and fintech better

Continuously iterate based on user feedback

Increase self-service feature to reduce inefficient support tasks

Closing our feature gaps

One of our top priorities was increasing transparency in payment activities, enabling customer support teams to investigate and resolve issues independently. During that phase, I designed and iterated on the following features:

ACH Transfers

Book Transfer

Check Issuing

Check Deposit

Network Transfer

Wire

Account & KYC Management

Card Program

User Management

Fintech Configuration

Search

API Documentation

Dashboard Metrics

As part of these work, I conducted various research activities to gain clarity and alignment on the features that needed to be developed.

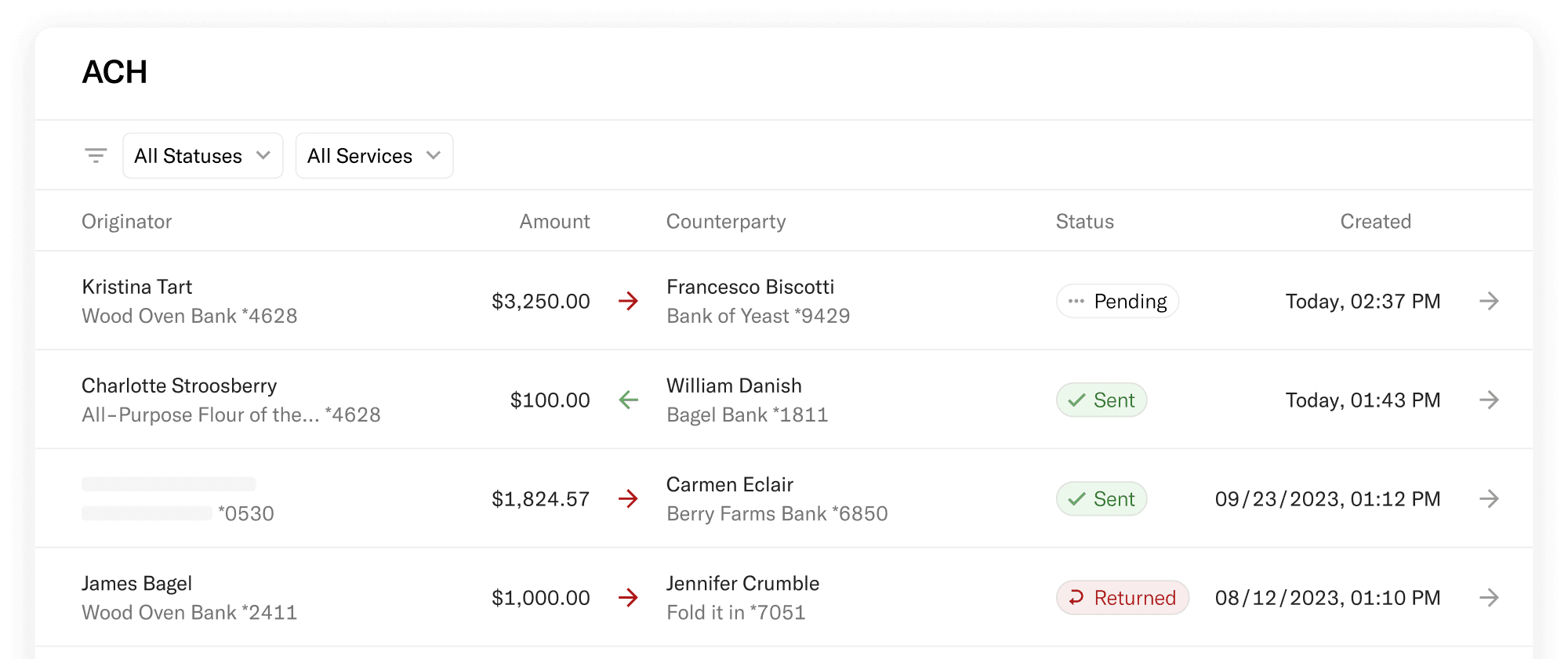

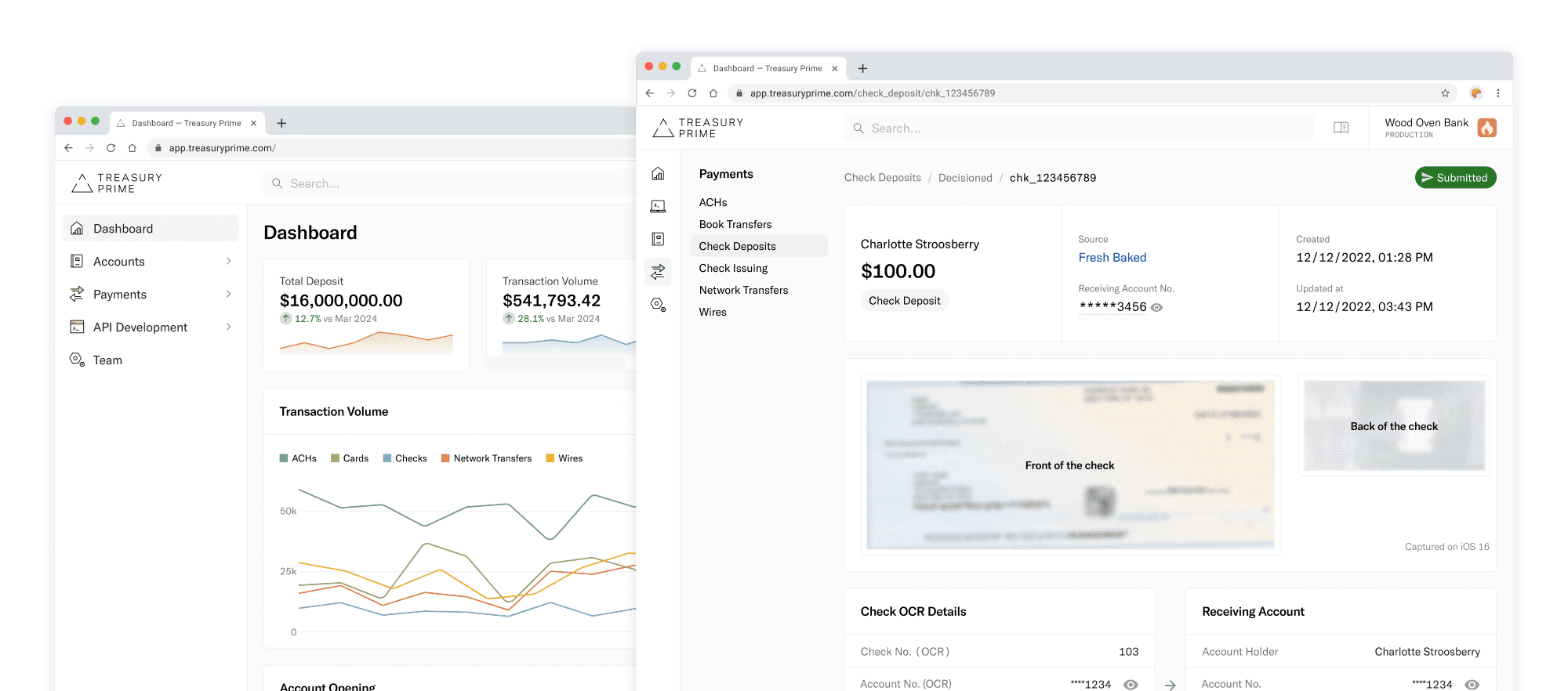

Payment Pages Improvements

After releasing our new payment pages, we talked to bank partners to identify ways to speed up their workflow and standardize our payment tables.

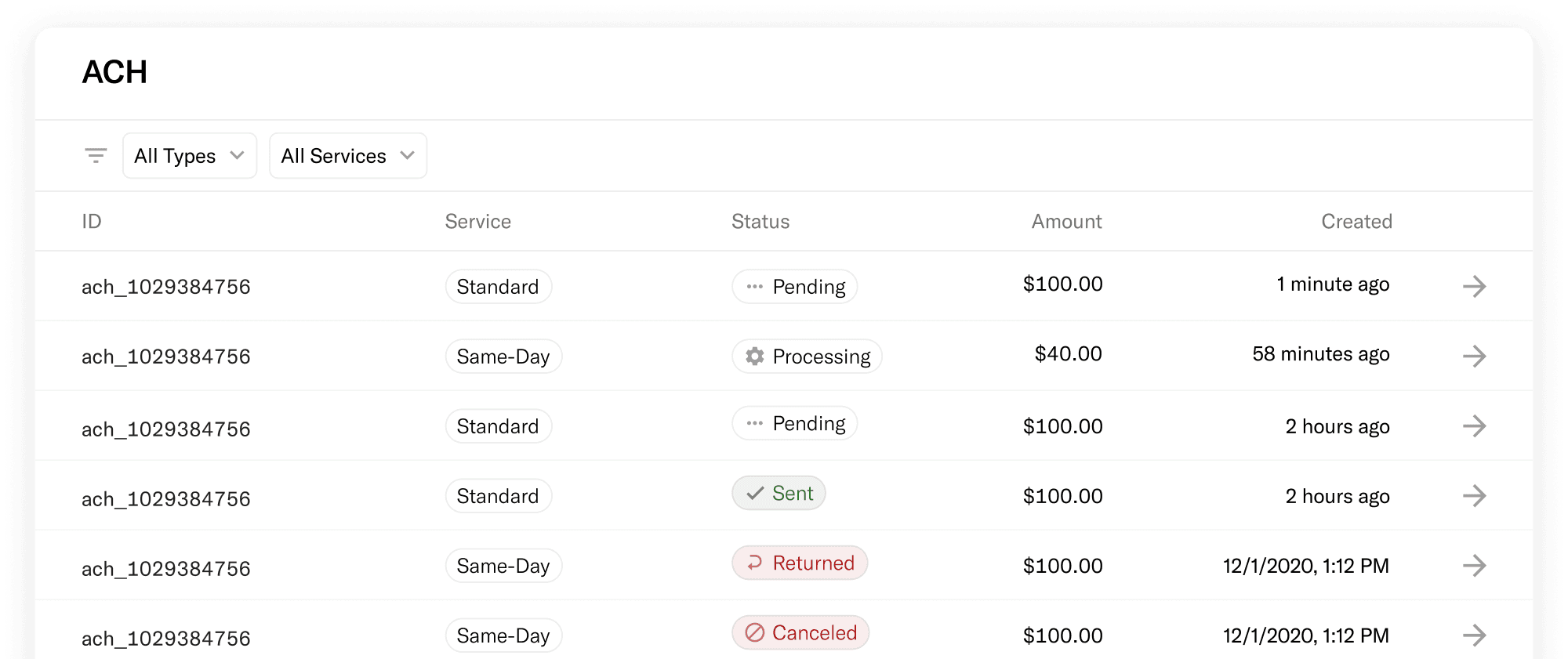

BEFORE

AFTER

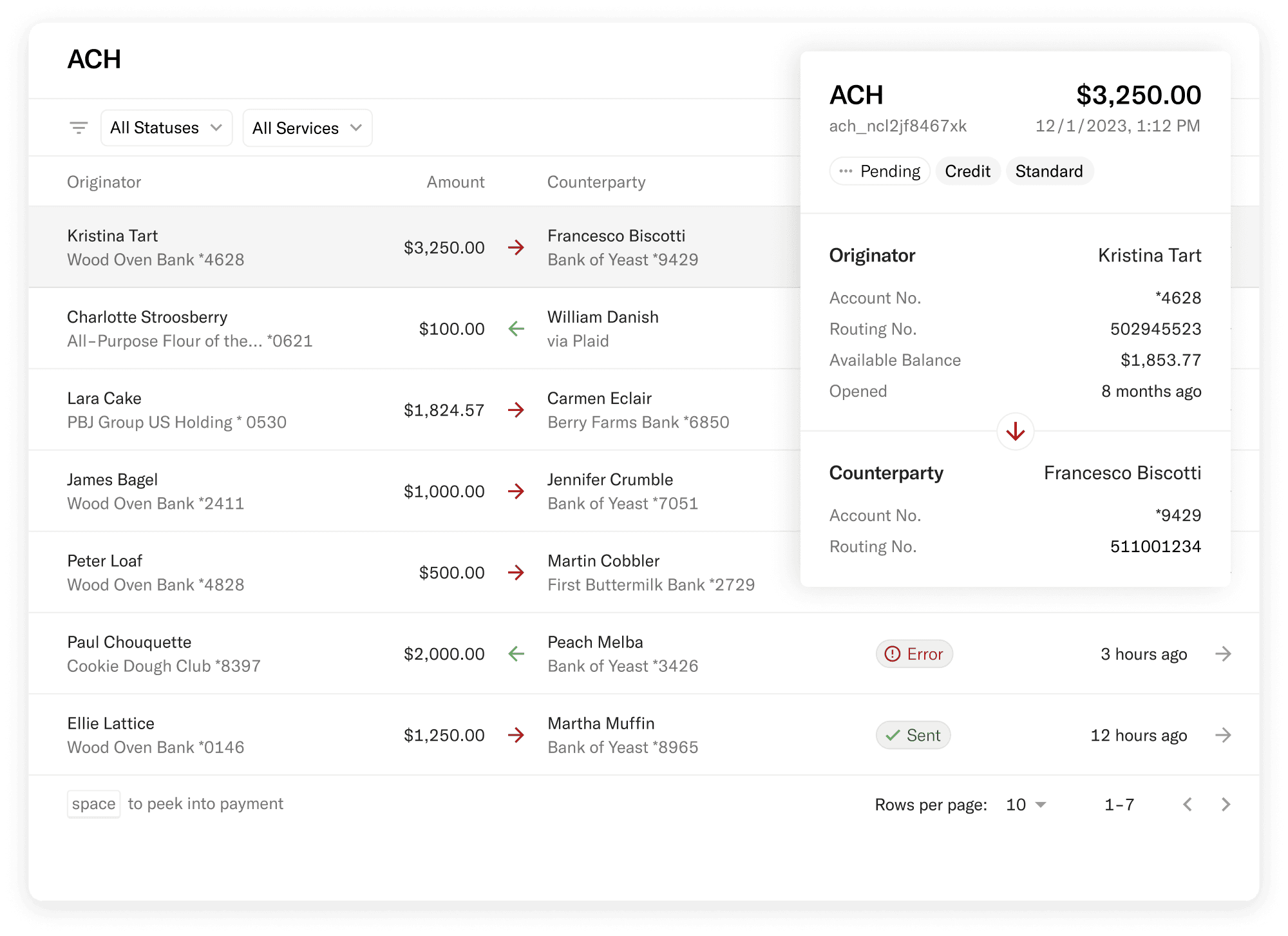

Based on users' input and validation, I updated the payment tables to make identifying bank and account holder information easier.

PEEK OVERLAY

To assist users in scanning and identifying payments, they can view additional information for each row of the table by pressing the spacebar.

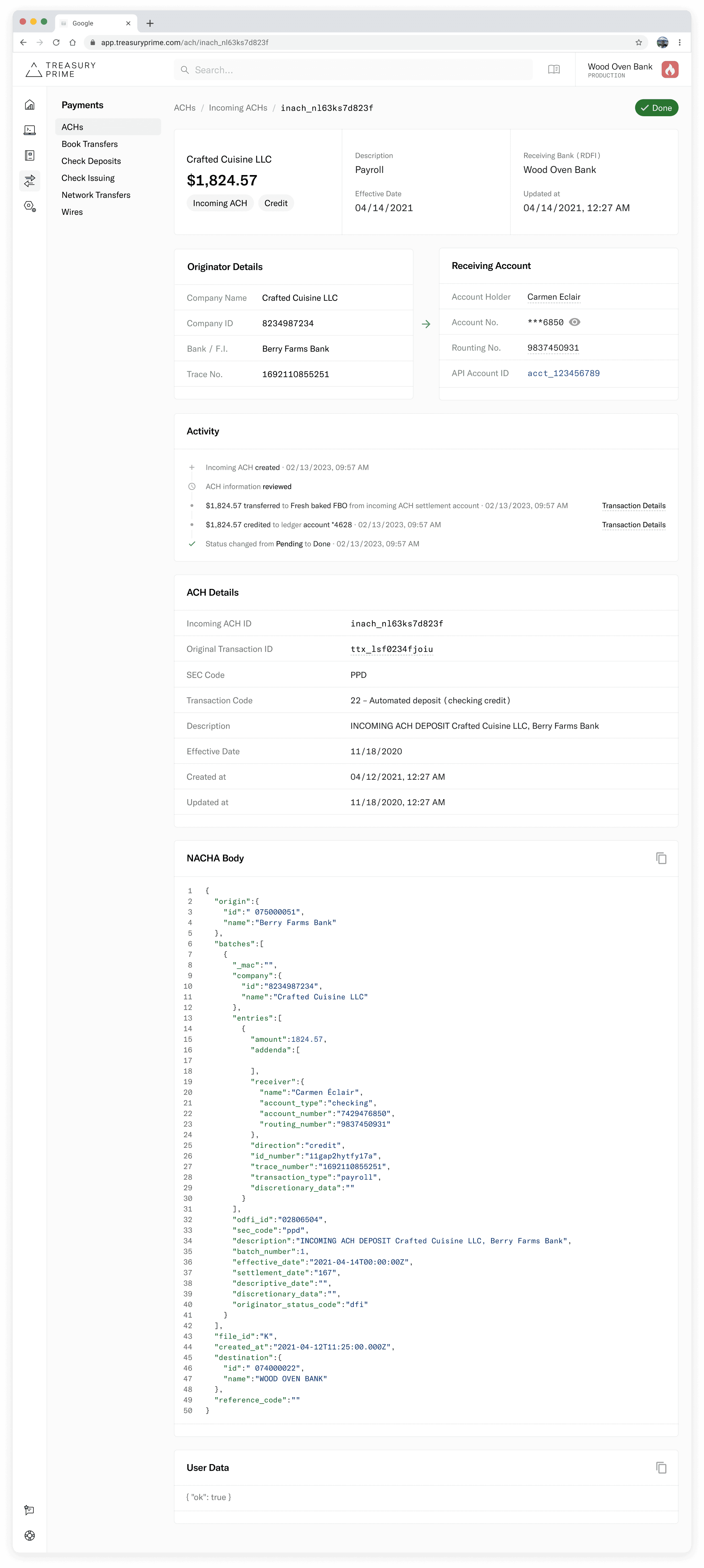

FLOW OF FUNDS

The payment details were designed to identify the flow of funds from the originator to the receiver and the resulting transactions and change of statuses.

Noticeable Improvements:

-43%

in support tickets

+81%

in user sessions

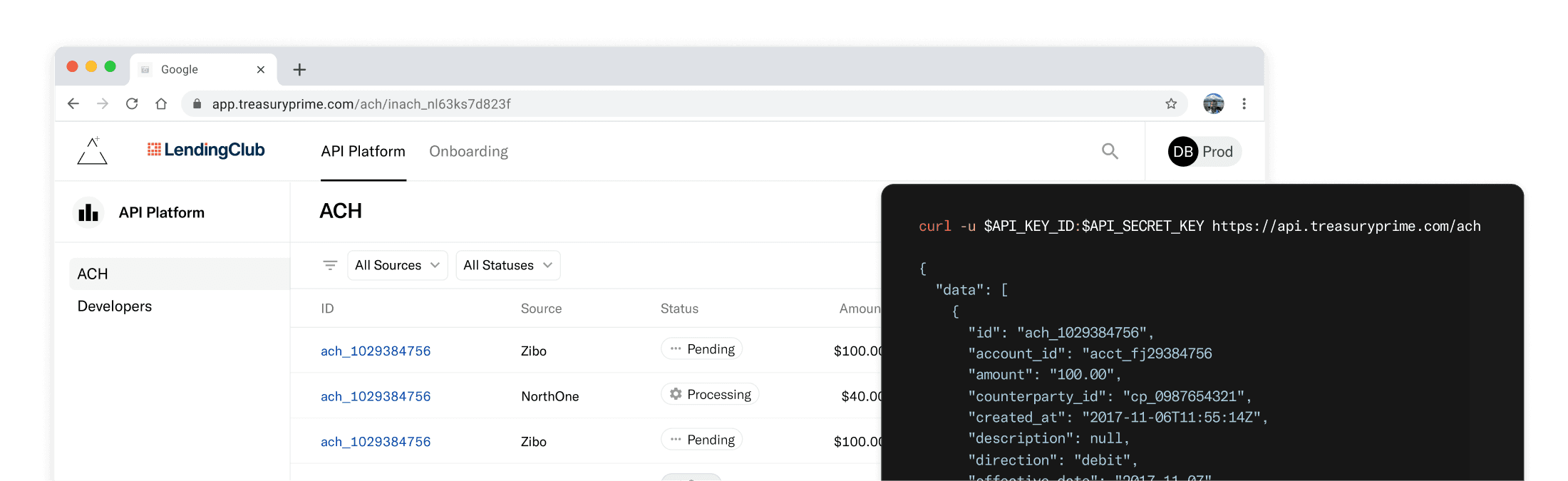

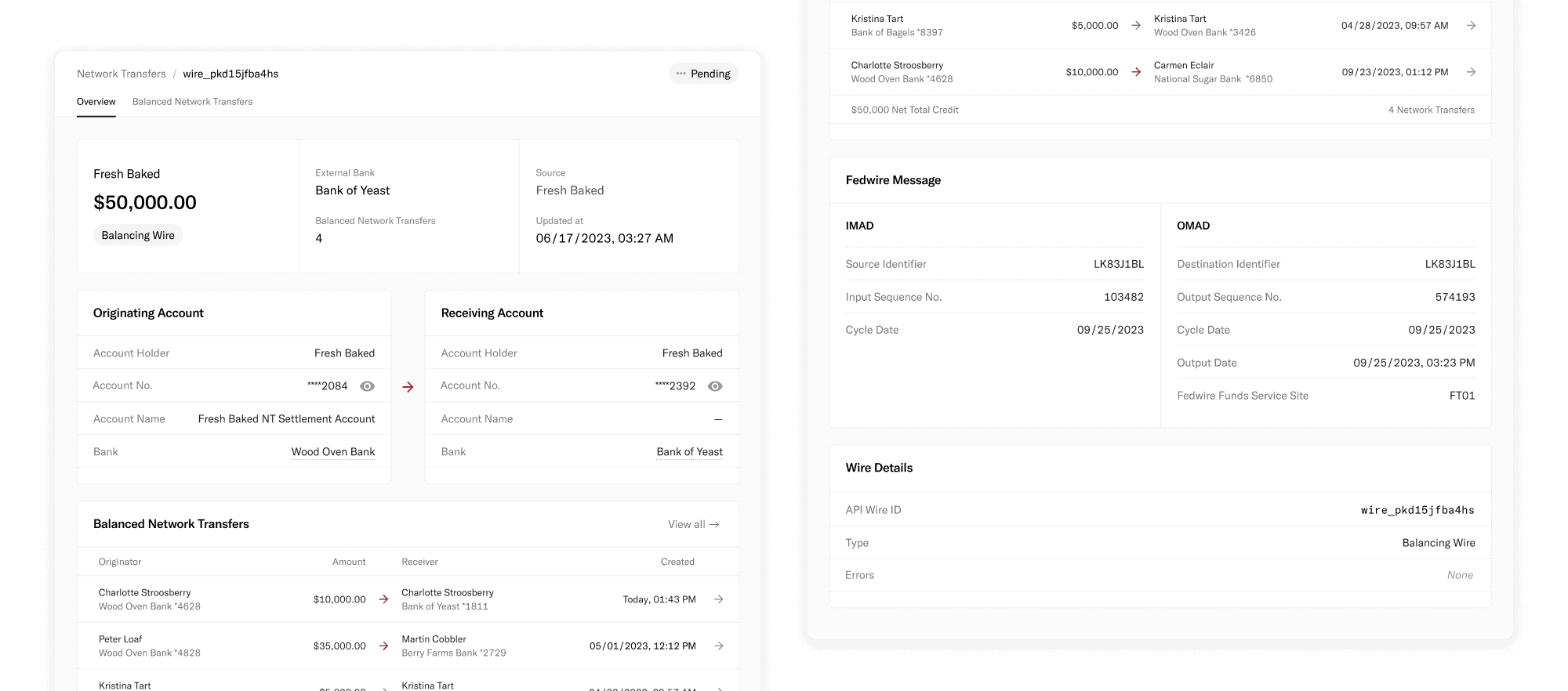

Supporting Cross-bank Money Movement

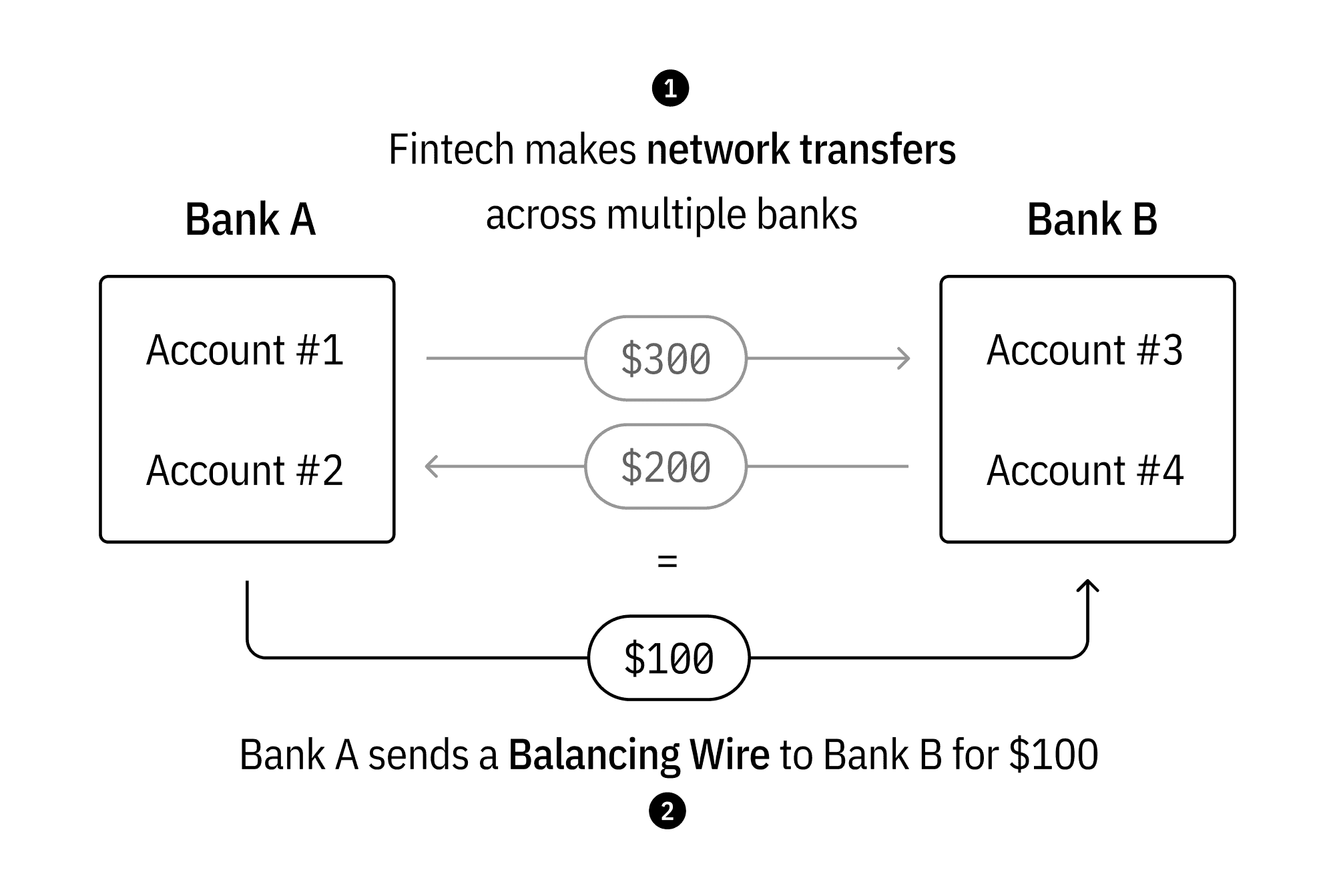

Using Treasury Prime's Network Transfers solution, fintech companies can transfer money instantly between accounts at different banks.

Early on, we discovered that banks needed assistance identifying the source of transfers, which slowed adoption despite its convenience for fintech operations.

THE BLINDSIDE

To address this issue, I've designed a new set of features that enabled our bank partners to gain visibility into the network transfers and the accounts involved, eliminating a daily and manual task from our support team.

+$100M

in payment volume

-55%

in support tickets

$440k

in influenced ARR

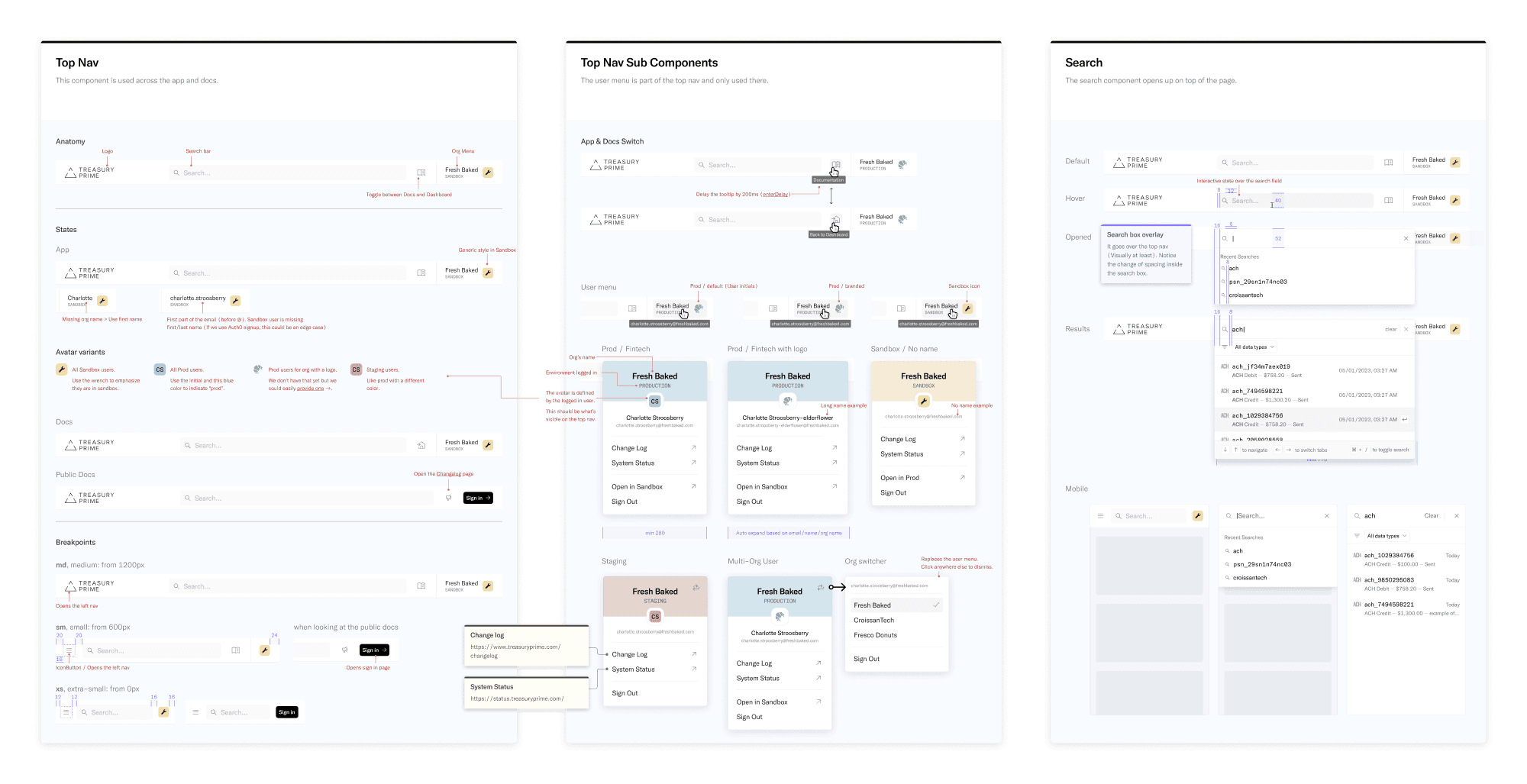

Redesign Effort

With more users on the platform, we realized that fintech and banks had similar use cases with just a few twists. As a result, I led the creation of a consolidated dashboard experience that adapts to the user role and privileges. The key areas of the redesign were:

Improve the navigation to support new pages

Minimize the difference between fintech and bank use cases

Clean up components and maximize reusability

To avoid overwhelming the user, we planned on updating the navigation while keeping the page content the same. We ran an internal testing phase and were planning on launching a beta phase to collect customer feedback.